Climate Change Considerations…

Please welcome Nathan Schaper, a devoted volunteer of Sustainable Hamilton Burlington and the Sustainability Leadership Program who is our guest blogger for this month’s post reflecting on why your business should care about climate resilience.

What if you could prevent tomorrow’s disasters? And what if you could protect your business from risks of the future? What if you could save your business from future climate risks?

Preparing your company for future climate risks may be easier than you think, and there are a few ways to prepare your business to build resilience against climate risks.

Corporate resiliency is essential for company stability and longevity – not only overcoming challenges but remaining successful through disruptions or disturbances such as recessions, pandemics and natural disasters. For example, COVID-19 has created a substantial disruption that no one could have ever imagined. However, there is a far more insidious, far more lasting disruptive impact that is being overshadowed by COVID-19: climate change. Climate change has the potential to create monumental changes to the economy, society and the environment. COVID-19 has businesses rethinking resilience, making now the best time for businesses to understand the potential risks associated with climate change, and to incorporate corporate resiliency to mitigate those risks and also create benefits.

Business risk has been increasing due to climate change and insurance companies have already seen a marked rise in insurance pay-outs over the past decade. The Insurance Board of Canada states that the Canadian insurance industry averaged about $400 million a year in catastrophic losses from 1983 through 2008. Since 2009 though, the annual average now five times more, around $2 billion.[1][2] This is representative of an underlying trend of significantly increased catastrophic losses in number and severity due to environmental events, including fires, floods, ice storms, rainstorms, and windstorms. Eight of the ten highest insurance loss years have occurred since – you guessed it – 2009.[3]

If you still are not convinced, I’ll leave it to Mark Carney, the former Governor of the Bank of Canada to explain: “I have found that insurers are amongst the most determined advocates for tackling [climate change] sooner rather than later. And little wonder. While others have been debating the theory, [they] have been dealing with reality.”[4] It is exactly the job of insurance companies to be aware of and mitigate risk, and they want to be prepared in case of disaster. For businesses, COVID-19 saw many companies that thought they were insured for pandemics but found out suddenly that they were not.[5] As a business, you want to be aware of the risks before they arise and ensure that your insurance company will be able to cover them. It is likely your insurance company is more prepared for climate change than you are; are you getting the best rates? Are you understanding the risks? Are you preparing your resiliency strategy?

Resilience is found in preparing for inevitable disasters before they happen. “The cost of identifying and undertaking adaptation actions is cheaper than the cost of restoring infrastructure after it has been damaged. What is needed now is an ambitious and long-term investment plan for disaster mitigation and adaptation,”[6] declared the Insurance Bureau of Canada. The Insurance Institute of Canada focuses on three main climate risks posed to businesses: physical risks, liability risks and transitional risks . [4]

Firstly, physical risks are the tangible damage to buildings and infrastructure. This is the risk of heavy precipitation, high winds, flooding, increased probability of power outages and grid failures, and also worker health and safety concerns from rising temperatures. Flooding is the main cause of increased physical climate risk in Ontario.[7] There are some simple ways to reduce flooding, such as increasing the use of permeable surfaces such as permeable pavement or green roofs, using low impact development design practices such as bioswales, infiltration tanks, etc. There are organizations with expertise and resources on decreasing physical risk like the Intact Centre on Climate Adaption, Credit Valley Conservation Low Impact Development Guidelines, the Insurance Bureau of Canada Flood Mitigation, or the Institute for Catastrophic Loss Reduction – Handbook for reducing basement flooding.

Secondly, liability risks are the potential legal actions against the organization related to climate, such as legal action resulting from historical inaction on climate change. There are increasing amounts of litigation due to climate ignorance or excessive polluting and companies need to be prepared for it.[8] This is why GHG emission accounting, sustainability reporting and climate-related financial disclosures are so important. Consumers, investors, and stakeholders can easily understand a business’ history on climate actions and assess their records by reviewing their reports. Businesses will then have a credible reporting record to draw from and can convince stakeholders and investors of the leadership and role they take to mitigate climate risks. Organizations such as Sustainable Hamilton Burlington can help you collect your sustainability data in a credible way, and recommend a clear approach to sustainability disclosures.

Finally, transitional risks are the risks associated with the shift of the economy and your business in its progression to a low-carbon future with different behaviours and practices. Our world is ever-changing, and so too are the conditions in which your business operates. For instance, consumers are demanding more sustainable products, producing reputation risk if your business is not meeting this cultural trend. [9] Furthermore, governments around the world are increasingly implementing sustainability standards that directly regulate business operations. Your business can proactively adjust to best practices to ensure a seamless transition, rather than risking backlash due to non-compliance.[10] Keep in tune with the Government of Canada sustainability updates, reap the benefits of government sustainability programs and grants and utilize the Disaster Adaptation and Mitigation Fund.

Figure 2: Devil’s Punchbowl

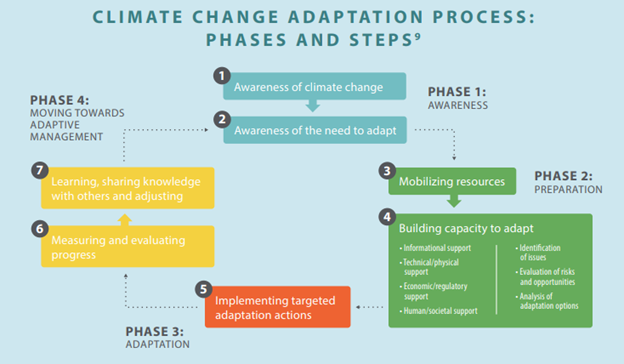

Being resilient does not need to be difficult – it just means being prepared and having a plan to mitigate risks when disaster inevitably strikes. The Business Development Bank of Canada recommends three things to increase resiliency:[11] First, embracing digital, the COVID-19 disaster has seen a sharp increase in online transactions, remote access, and work patterns; this will keep the business competitive in the digital age. Second, diversifying products and supply chains including exploring adjacent customers or geographies as well as different products or services to ensure that if one part of the business is lacking it can be quickly made up in other areas. Thirdly, the importance of agility. Small- and medium-sized enterprises are built to quickly pivot and adjust operations if need be. During the pandemic, quick pivots were seen by distilleries making hand sanitizer or clothing companies making masks. At SHB, we recommend starting with a focus on the climate risks posing the greatest threats to your organization, and developing an action plan to understand and prepare for those risks. One way would be the TCFD Assessment of climate change risks and opportunities, the EPA being prepared for climate change workbook, or Scenario Analysis.

Figure 3: Climate Change Adaptation Process

Is it possible to withstand the next pandemic, disaster, or change? Absolutely! But only if your business is ready to develop a resiliency plan that can anticipate increasing climate risk, changing the way you are willing to approach business. After all, like in Aesop’s fable: it is “better to yield when it is folly to resist, than to resist stubbornly and be destroyed.”[12] Let’s start thinking of our businesses differently, and building resilience to sustain our businesses into the future.

Sources.

[2] http://assets.ibc.ca/Documents/Facts%20Book/Facts_Book/2020/IBC-2020-Facts.pdf

[5] https://www.nytimes.com/2020/08/05/business/business-interruption-insurance-pandemic.html

[6] http://assets.ibc.ca/Documents/Disaster/The-Cost-of-Climate-Adaptation-infographic-EN.pdf

[7] https://globalnews.ca/news/5206116/100-year-floods-canada-increasing/

[8] https://www.nature.com/articles/d41586-020-00175-5

[10] Bob Willard. The Sustainability Advantage (2002). https://sustainabilityadvantage.com/

[11] https://www.bdc.ca/en/articles-tools/blog/covid19-making-your-business-resilient-pandemic-beyond

[12] http://read.gov/aesop/011.html

FIGURES

[1] http://freephotoshamilton.ca/freephotos/a-shadow-over-hamilton/

[2] http://freephotoshamilton.ca/freephotos/devils-punch-bowl-cliff-face-focus-shot/

[3] http://assets.ibc.ca/Documents/Disaster/The-Cost-of-Climate-Adaptation-infographic-EN.pdf