Please welcome Jordyn Divok, a devoted team member of Sustainable Hamilton Burlington and the Sustainability Leadership Program who is our guest blogger for this month’s post reflecting on building business resiliency.

Hindsight is 20/20. A common phrase to dictate that you don’t know what might happen until it happens, where being unprepared for the ramifications is an accepted reality. Your business should refuse to accept this, and here’s why.

Currently, businesses operate under a business-as-usual model, focusing on improving efficiency at the cost of resiliency when “business-as-usual” changes (Saenz et al., 2021). Resiliency – the ability to respond to shocks and continue being successful – is reduced, or in some cases, completely non-existent if efficiency is the only focus. By prioritizing efficiency, businesses have decided to leave themselves exposed to risks, resulting in greater business volatility. Volatility refers to predictable fluctuations in business over time, but taking that a step further, it also means your business being exposed to what can be lasting adverse changes in your business – and its profitability (O’Keefe et al., 2021). The Bain Resiliency Index identifies a comparison with businesses at the macro scale from 1980-1999 versus 2000-2018. With the increased focus in this latter period on efficiency, the volatility for businesses’ expected profits increased by 60% (O’Keefe et al, 2021). When looking at businesses at an individual scale, the volatility coincides with a higher probability of failure. This means that despite efficiency having high risk, and potentially high rewards, it can also be catastrophic for the longevity of your business. In fact, more resilient companies have nearly double the survival rate compared to non-resilient companies (O’Keefe et al., 2021).

So how does your business become resilient? Firstly, understanding the dimensions of resilience can help your business identify where risks may occur and how to overcome them (O’Keefe et al., 2021). It is important for your business to mitigate risks, and build its resilience in 4 different dimensions: strategic, financial, operational, and technological.

Strategic resilience refers to the mindset of the business in how it adjusts to disruptions. Seeing disruptions as an inevitability, rather than an unlikely occurrence, can help businesses strategize their business continuity plan to accept and adapt to disruptions. Businesses are dynamic, and having business leaders synchronize their organization to embed fluidity into their practices can help alleviate risks, and more easily adapt when they occur (Coffaro, 2020). Relying on your business vision and values provides the constant your organization relies on, despite making adaptations and adjustments for the disruption. Adapting to changes in demand, and diversifying products and services can aid your business in remaining resilient in high times and low. However, relying on the long-term goals and vision of your business ensures your organization remains resilient from disruption to disruption (Coffaro, 2020).

Financial resilience refers to the ability to withstand and overcome financial disruptions (Simmonds and Tinsley, 2011). This includes investing some profits in high times to reduce risks in the future, getting your business through the inevitable lows. One of the greatest examples of this financial resilience occurred at Wimbledon last year. Wimbledon had, for the past 17 years, purchased “pandemic insurance” which cost the organization about $2 million per year, totaling $34 million USD (Togoh, 2020). Although this cost may have been seen as an inefficient use of profits to some, Wimbledon was willing to invest it in this insurance, knowing that the losses due to a pandemic would be near catastrophic for the organization. And they were right. In 2020, the COVID-19 pandemic put a sudden and immediate halt on the annual Wimbledon Tennis Championship, one of the major tennis events globally (Togoh, 2020). Thanks to the pandemic insurance, Wimbledon managed to recoup $141 million USD, covering their costs and most of (if not all) potential losses. Even for small/medium enterprises, putting in some costs to protect your business from future risks – whether pandemic, physical risks, or otherwise – is a smart investment.

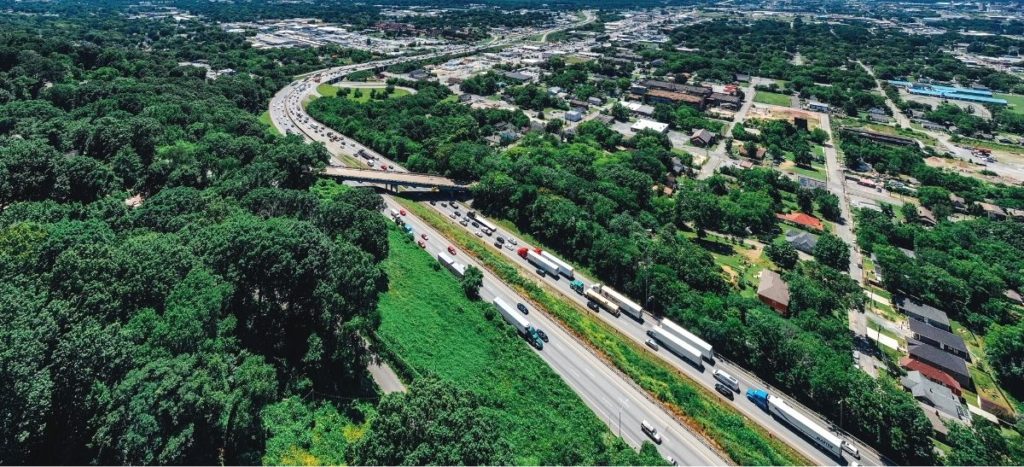

Operational resilience refers to mitigating risks in how your business operates. Opportunities for mitigating risks include operating leverage, supplier concentration, and redundancy (O’Keefe et al, 2021). Supply chains are a particularly risk-intensive area for most businesses. Concentrating your procurement amongst just a few suppliers makes it easier to manage, but increases vulnerability should disruptions occur (Lund et al., 2020). Research performed by the McKinsey Global Institute showed that the industries researched had reported experiencing material disruptions lasting a month or longer every 3.7 years on average, with shorter supply chain disruptions occurring even more frequently (Lund et al., 2020). Diversifying suppliers geographically can help mitigate risks and supply chain delays. Where possible, and particularly for small/medium enterprises that are at greater risk of business failure due to supply chain disruptions, regionalizing your supply chains can help your business reduce risks and maintain its productivity. Regionalized supply chains experience less shocks compared to global supply chains, which rely on more trade of products between suppliers and across larger geographical areas (Lund et al., 2020).

Technological resilience refers to implementing technologies, while mitigating risks associated with their use. As e-commerce and online purchasing continues to rise, businesses should invest in this new sphere. However additional risks occur in this online sphere such as cybersecurity threats and mass server shutdowns (Saenz et al., 2020).

Your business should identify potential risks and threats of the future, not just the past. Perform a risk assessment to determine which risks present a larger hazard for your business, and take measures to address them. Ensure that when considering risks, your business considers the whole business, rather than looking at specific threats in specific departments. The more your business can create large-scale risk reductions through a given implementation, the greater resilience will occur at a lesser cost compared to individualized implementations (O’Keefe et al, 2020; Saenz et al., 2020). By building your business resilience, you won’t get caught accepting the ramifications and vulnerabilities associated with disruptions occurring. Never again will you have to say hindsight is 20/20.